In an era where sustainability is no longer optional but imperative, businesses embracing sustainable growth strategies are paving the way for a prosperous and responsible future.

Sustainable growth is a strategic imperative for modern businesses seeking long-term success. Companies prioritizing sustainability outperform competitors with higher returns and enhanced brand value. Aligning business strategy with sustainable principles unlocks value creation and positions your brand as a responsible corporate citizen.

Embedding sustainability requires a solid financial foundation, strategic capital allocation, and leveraging technology and innovation as powerful enablers. Companies driven by sustainability are well-positioned to capitalize on emerging opportunities and maintain a competitive edge.

The Strategic Imperative of Sustainable Growth

The writing is on the wall – sustainable growth can no longer be treated as an afterthought or a box to check. In today’s rapidly evolving business landscape, it’s a strategic imperative that can make or break an organization’s long-term viability. Companies prioritizing sustainability are reaping rewards, outperforming competitors with higher returns on equity. By aligning your business strategy with sustainable growth principles from the ground up, you unlock long-term value creation and future-proof your organization against mounting environmental and social pressures.

Beyond the financial gains, embedding sustainability into your core operations has far-reaching benefits. It positions your brand as a responsible corporate citizen, one that is attuned to the needs of the planet and society. This resonates deeply with increasingly conscious customers and investors, enhancing your brand value and reputation. In today’s marketplace, sustainability is not just a buzzword; it’s a badge of honor that can set you apart from the competition.

Analyzing the Financial Health for Sustainable Growth

While the strategic and ethical imperatives of sustainable growth are clear, it’s crucial to establish a solid financial foundation. Sustainable growth initiatives require resources and investment, which is why it’s crucial to regularly monitor key financial metrics like cash flow, profitability ratios, and debt-to-equity levels. This will give you a clear picture of your business’s financial health and its ability to support sustainable growth initiatives.

For businesses seeking additional funding options to fuel their sustainable growth strategies, a 0% interest Visa credit card can provide a valuable financing solution. These cards offer an introductory period of 0% APR, allowing businesses to leverage interest-free financing while implementing sustainable initiatives and optimizing their cash flow. By carefully managing their credit utilization and making timely payments, businesses can take advantage of this financing option to drive their sustainable growth efforts without incurring additional interest costs. Local financial institutions like Meridian credit cards are also excellent resources for exploring sustainable financing options that align with your business’s goals and values.

Companies with robust sustainable business practices are more likely to achieve above-average financial performance in the long run. This is because sustainability often goes hand-in-hand with operational efficiency, resource optimization, and risk mitigation – all of which contribute to a healthier bottom line.

Strategic capital allocation is paramount, ensuring that sufficient resources are dedicated to sustainable initiatives without compromising other essential areas of your business. A strong cash flow position and effective cost management provide the financial flexibility to invest in sustainable growth opportunities as they arise.

Leveraging Technology and Innovation for Sustainable Success

Technology is a powerful enabler for sustainable growth, driving efficiency and scalability in ways that were once unimaginable. Investing in sustainable technologies like renewable energy solutions and supply chain optimization software can boost your return on assets significantly. These technologies not only reduce your environmental footprint but also streamline operations and unlock cost savings.

Innovation, however, extends far beyond adopting new technologies. It’s about rethinking your entire business model, challenging the status quo, and embracing disruptive approaches to sustainability. Case studies showcase how companies embracing the circular economy and shared value strategies are achieving sustainable growth while minimizing their environmental impact.

Some examples of innovative and sustainable business models include:

- Circular Economy: Companies like Renault aim to eliminate waste by keeping materials and products in circulation for as long as possible through reuse, refurbishment, and recycling. They have saved millions by remanufacturing and reusing materials.

- Shared Value: Nestlé’s Creating Shared Value strategy focuses on creating economic value by addressing societal needs and challenges. They have implemented initiatives to improve farmers’ livelihoods, promote nutrition, and conserve water resources while driving business growth.

Even traditional business models can benefit from sustainable practices like energy efficiency, waste reduction, and responsible sourcing. Identifying opportunities to cut costs, increase efficiency, and mitigate risks is key to achieving a competitive advantage through sustainability.

The Human Factor: Leadership, Culture, and Employee Engagement

Sustainable growth is not solely about financial metrics and operational processes; it’s a cultural transformation that requires buy-in and engagement from every level of your organization. Strong leadership is crucial for fostering a sustainability-focused mindset and rallying employees around this shared purpose.

Companies with engaged employees experience 21% higher profitability and 17% higher productivity. Empowering your workforce and involving them in sustainability efforts isn’t just the right thing to do; it’s a strategic advantage for driving sustainable growth. When employees feel invested in your sustainability initiatives, they become brand ambassadors, advocates, and change agents, propelling your organization towards its sustainability goals.

Cultivating a culture of sustainability requires more than just top-down directives; it involves creating opportunities for collaboration, open dialogue, and continuous learning. By involving employees in the decision-making process and encouraging them to share their ideas and perspectives, you foster a sense of ownership and accountability towards your sustainability initiatives.

Navigating External Challenges and Opportunities

While internal factors are essential, sustainable growth also requires staying attuned to external trends and market shifts. Regulatory changes, economic uncertainty, and global crises can all impact your sustainability journey, presenting both challenges and opportunities.

Rising regulatory compliance costs related to environmental and social issues can be a significant challenge for businesses. However, the transition to a low-carbon economy also presents immense opportunities for companies prepared to innovate and adapt.

By staying informed about emerging regulations, market trends, and consumer preferences, you can identify potential roadblocks and opportunities early on. This allows you to proactively mitigate risks, seize new opportunities, and pivot your sustainability strategies as needed. Collaborating with local organizations like the Boise, Idaho credit unions, can provide valuable insights and support in navigating these external factors.

Sustainable Growth Financing: Options and Strategies

Funding is often a roadblock for sustainable initiatives, but innovative financing options like green bonds, impact investing, and sustainability-linked loans are gaining traction. These instruments allow businesses to access capital while demonstrating their commitment to sustainability.

When selecting financing options, it’s essential to consider the alignment with your sustainability goals and targets, long-term cost-effectiveness, and reporting and transparency requirements. A well-planned financing strategy can help you scale your sustainable growth initiatives without compromising financial stability.

Collaboration with financial institutions, impact investors, and other stakeholders can open up new avenues for sustainable financing. By clearly articulating your sustainability vision and the potential impact of your initiatives, you can attract investors and lenders who are committed to supporting sustainable development.

Measuring and Communicating Sustainable Growth

The adage “what gets measured gets managed” rings true for sustainable growth as well. Implement robust measurement frameworks to track your progress against key sustainability metrics like greenhouse gas emissions, water usage, waste diversion rates, and diversity and inclusion metrics.

Regular monitoring and reporting of these metrics not only help you identify areas for improvement but also demonstrate your commitment to transparency and accountability. With 85% of investors increasingly considering Environmental, Social, and Governance (ESG) factors in their investment decisions, clear communication of your sustainability achievements and initiatives is crucial.

Leverage various channels, such as sustainability reports, investor presentations, and digital platforms, to share your sustainability journey with stakeholders. Highlight your successes, challenges, and lessons learned, fostering trust and credibility within your industry and among your customers and investors.

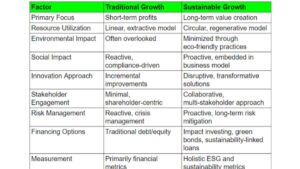

Comparison Table: Traditional vs. Sustainable Growth Strategies

Frequently Asked Questions

1. What is the difference between rapid growth and sustainable growth?

Rapid growth often prioritizes short-term gains over long-term viability, leading to unsustainable practices and increased risks. In contrast, sustainable growth focuses on measured, strategic expansion that aligns with environmental, social, and governance (ESG) principles, ensuring long-term success and resilience.

2. How can small businesses implement sustainable growth strategies with limited resources?

Small businesses can leverage their agility and innovation to adopt sustainable practices incrementally. Start with low-cost initiatives like energy efficiency, waste reduction, and responsible sourcing. Tap into local networks and resources like the >credit unions in Nampa, Idaho, for guidance and support. Every small step towards sustainability contributes to long-term growth.

3. Can sustainable growth strategies be applied in any industry, or are they sector-specific?

While specific sustainable practices may vary across industries, the core principles of sustainable growth – such as resource efficiency, stakeholder engagement, and long-term value creation – are universally applicable. Businesses in any sector can adapt these principles to their unique contexts and challenges.

Looking Ahead: The Future of Sustainable Growth

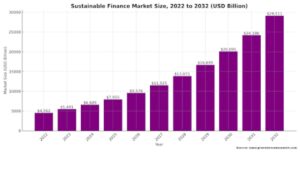

As we move towards a more sustainable future, the global sustainable finance market is projected to grow significantly, providing ample opportunities for businesses that align their operations, products, and services with sustainability principles.

The circular economy, in particular, is expected to generate millions of new jobs as companies shift towards more sustainable production and consumption models. By embracing these trends today, you’ll be well-positioned to capitalize on emerging opportunities and stay ahead of the curve.

Sustainable growth is no longer a luxury reserved for a select few; it’s a vital component of long-term business success in an ever-changing global landscape. By integrating sustainability into your core operations, products, and services, you’ll not only future-proof your company but also unlock new opportunities for innovation, efficiency, and profitability.